Balbharati solutions for Book-keeping and Accountancy 12th Standard HSC Maharashtra State Board

Chapter 5 - Reconstitution of Partnership (Death of Partner) [Latest edition]

- Select the most appropriate answer from the alternative given below and rewrite the sentence.

- Write a word, term, phrase, which can substitute the following statement.

- State whether the following statement is True or False with reason.

- Fill in the blank and rewrite the following sentence.

- Answer in one sentence only.

Practical Problems | Q 1 | Page 202

Rajesh, Rakesh, and Mahesh were equal Partner on 31st March 2019. Their Balance Sheet was as follows 31st March 2019.

Balance Sheet as on 31st March 2019

| Liabilities | Amount ₹ | Assets | Amount ₹ |

|---|---|---|---|

| Capital Account : | Land and Building | 4,00,000 | |

| Rajesh | 5,00,000 | Furniture | 3,00,000 |

| Rakesh | 2,00,000 | Debtors | 3,00,000 |

| Mahesh | 2,00,000 | Stock | 1,00,000 |

| Sundry creditors | 90,000 | Cash | 1,00,000 |

| Bills Payable | 60,000 | ||

| Bank loan | 1,50,000 | ||

| Total | 12,00,000 | Total | 12,00,000 |

Mr. Rajesh died on 30th June 2019 and the following adjustment were agreed as:

- Furniture was to be adjusted to its market price of 3,40,000

- Land and Building was to be depreciated by 10%

- Provide R.D.D 5% on debtors

- The Profit up to the date of death of Mr. Rajesh is to be calculated on the basis of last years profit which was ₹1,80,000

Prepare:

- Profit and Loss adjustment A/c

- Partners capital account

- Balance sheet of the continuing firm

Solution

In the books of the Partnership Firm Profit and Loss Adjustment Account

| Particulars | Amount (₹) | Particulars | Amount (₹) |

|---|---|---|---|

| To Land and Building A/c | 40,000 | By Furniture A/c | 40,000 |

| To R.D.D. A/c | 15,000 | By Partners’ Capital A/c (Loss) | |

| Rajesh | 5,000 | ||

| Rakesh | 5,000 | ||

| Mahesh | 5,000 | ||

| 15,000 | |||

| Total | 55,000 | Total | 55,000 |

Partners’ Capital Account

| Particulars | Rajesh (₹) | Rakesh (₹) | Mahesh (₹) | Particulars | Rajesh (₹) | Rakesh (₹) | Mahesh (₹) |

|---|---|---|---|---|---|---|---|

| To Profit and Loss Adjustment A/c – Loss | 5,000 | 5,000 | 5,000 | By Balance b/d | 5,00,000 | 2,00,000 | 2,00,000 |

| To Rajesh's Executor’s A/c | 5,10,000 | By Profit and Loss Suspense A/c | 15,000 | ||||

| To Balance c/d | 1,95,000 | 1,95,000 | |||||

| Total | 5,15,000 | 2,00,000 | 2,00,000 | Total | 5,15,000 | 2,00,000 | 2,00,000 |

Balance Sheet as on 1st July 2019

| Liabilities | Amount (₹) | Amount (₹) | Assets | Amount (₹) | Amount (₹) |

|---|---|---|---|---|---|

| Capital Accounts : | Land and Building | 4,00,000 | |||

| Rakesh | 1,95,000 | Less: Depreciation | 40,000 | 3,60,000 | |

| Mahesh | 1,95,000 | 3,90,000 | Furniture | 3,00,000 | |

| Rajesh’s Executor’s Loan A/c | 5,10,000 | Add: Appreciation | 40,000 | 3,40,000 | |

| Sundry Creditors | 90,000 | Debtors | 3,00,000 | ||

| Bills Payable | 60,000 | Less: R.D.D. (5%) | 15,000 | 2,85,000 | |

| Bank Loan | 1,50,000 | Stock | 1,00,000 | ||

| Cash | 1,00,000 | ||||

| Profit and Loss Suspense A/c | 15,000 | ||||

| Total | 12,00,000 | Total | 12,00,000 |

Working Note :

The profit of the firm last year was ₹ 1,80,000.

Proportionate profit up to the date of death for Rajesh is as follows = 1,80,000 x (3/12) x (1/3) = ₹ 15,000

Practical Problems | Q 2 | Page 202

Rahul, Rohit, and Ramesh are in a business sharing profits and losses in the ratio of 3:2:1 respectively. Their balance sheet as on 31st March 2017 was as follows.

Balance Sheet as on 31st March 2017

| Liabilities | Amount ₹ | Assets | Amount ₹ | Amount ₹ |

|---|---|---|---|---|

| Capital Account: | Debtors | 1,00,000 | ||

| Rahul | 2,20,000 | Less: R. D. D. | 10,000 | 90,000 |

| Rohit | 2,10,000 | Plant and Machinery | 85,000 | |

| Ramesh | 2,40,000 | Investment | 3,50,000 | |

| Creditors | 80,000 | Motor lorry | 1,00,000 | |

| Bills Payable | 7,000 | Building | 80,000 | |

| General Reserve | 96,000 | Bank | 1,48,000 | |

| Total | 8,53,000 | Total | 8,53,000 |

On 1st October 2017, Ramesh died and the Partnership deed provided that:

- R.D.D. was maintained at 5% on Debtors

- Plant and Machinery and Investment were valued at ₹ 80,000 and ₹ 4,10,000 respectively.

- Of the creditors, an item of ₹ 6000 was no longer a liability and hence was properly adjusted.

- Profit for 2017-18 was estimated at ₹ 120,000 and Ramesh share in it up to the date of his death was given to him.

- Goodwill of the Firm was valued at two times the average profit of the last five years. Which were:

Ramesh share in it was to be given to him.

2012-13 ₹ 1,80,000 2013-14 ₹ 2,00,000 2014-15 ₹ 2,50,000 2015-16 ₹ 1,50,000 2016-17 ₹ 1,20,000 - Salary 5,000 p.m. was payable to him

- Interest on capital at 5% i.e. was payable and on Drawings ₹ 2000 were charged.

- Drawings made by Ramesh up to September 2017 were ₹ 5,000 p.m.

Prepare:

Ramesh’s Capital A/c showing the amount payable to his executors

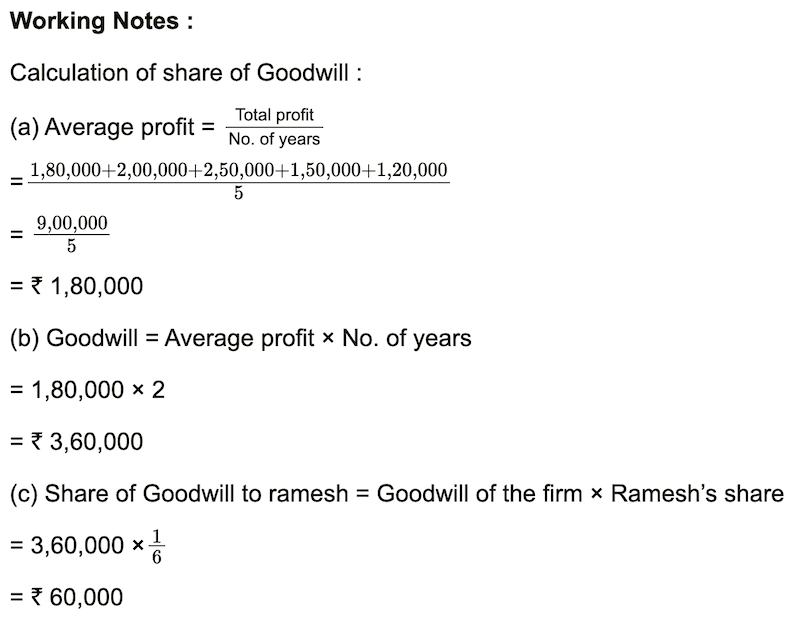

Give Working of Profit and Goodwill

Ramesh Capital Balance ₹ 3,41,000

View Solution

In the books of the Partnership Firm Ramesh’s Capital Account

| Particulars | Amount (₹) | Particulars | Amount (₹) |

|---|---|---|---|

| To Drawings A/c | 30,000 | By Balance b/d | 2,40,000 |

| To Interest on Drawings A/c | 2,000 | By Goodwill A/c | 60,000 |

| To Executor’s Loan A/c | 3,41,000 | By Salary A/c | 30,000 |

| By Interest on Capital A/c | 6,000 | ||

| By Profit and Loss Adjustment A/c – Profit | 11,000 | ||

| By Profit and Loss Suspense A/c | 10,000 | ||

| By General reserve A/c | 16,000 | ||

| Total | 3,73,000 | Total | 3,73,000 |

(4) Profit and Loss Adjustment Account

| Particulars | Amount (₹) | Particulars | Amount (₹) |

|---|---|---|---|

| To Plant and Machinery A/c | 5,000 | By R.D.D. A/c | 5,000 |

| To Partners’ Capital A/cs (Profit): | By Investments A/c | 60,000 | |

| Rahul (3/6) | 33,000 | By Creditors A/c | 6,000 |

| Rohit (2/6) | 22,000 | ||

| Ramesh (1/6) | 11,000 | ||

| 66,000 | |||

| Total | 71,000 | Total | 71,000 |

Practical Problems | Q 3 | Page 203

Ram, Madhav, and Keshav are partners sharing Profit and Losses in the ratio 5:3:2 respectively. Their Balance Sheet as on 31st March 2018 was as follows.

Balance Sheet as on 31st March 2018

| Liabilities | Amount ₹ | Assets | Amount ₹ |

|---|---|---|---|

| General Reserve | 25,000 | Goodwill | 50,000 |

| Creditors | 1,00,000 | Loose Tools | 50,000 |

| Unpaid Rent | 25,000 | Debtor | 1,50,000 |

| Capital Accounts | - | Live Stock | 1,00,000 |

| Ram | 1,00,000 | Cash | 25,000 |

| Madhav | 75,000 | ||

| Keshav | 50,000 | ||

| Total | 3,75,000 | Total | 3,75,000 |

Keshav died on 31st July 2018 and the following Adjustment were agreed by as per partnership deed.

- Creditors have increased by 10,000

- Goodwill is to be calculated at 2 years purchase of average profits of 5 years.

- The Profits of the preceding 5 years was:

Keshav's share in it was to be given to him.

2013-14 ₹ 90,000 2014-15 ₹ 1,00,000 2015-16 ₹ 60,000 2016-17 ₹ 50,000 2017-18 ₹ 50,000 (Loss) - Loose Tools and livestock were valued at ₹ 80,000 and ₹ 1,20,000 respectively

- R.D.D. was maintained at ₹ 10,000

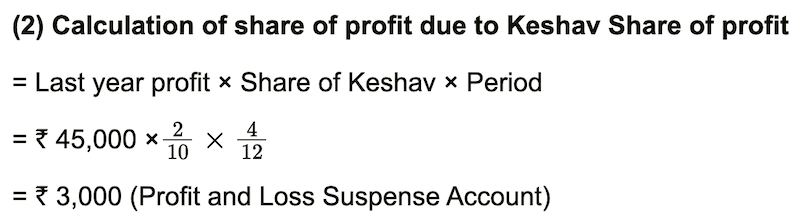

- Commission ₹ 2,000 p.m. was payable to Keshav. Profit for 2018-19 was estimated at ₹ 45,000 and Keshav's share in it up to the date of his death was given to him.

Prepare:

Revaluation A/c, Keshav’s capital A/c showing the amount payable to his executors.

Solution

In the books of the Partnership Firm Revaluation Account

| Particulars | Amount (₹) | Particulars | Amount (₹) |

|---|---|---|---|

| To R.D.D. A/c | 10,000 | By Loose Tools A/c | 30,000 |

| To Creditors A/c | 10,000 | By Live Stock A/c | 20,000 |

| To Partners’ capital A/c – Profit: | |||

| Ram (5/10) | 15,000 | ||

| Madhav (3/10) | 9,000 | ||

| Keshav (2/10) | 6,000 | ||

| 30,000 | |||

| Total | 50,000 | Total | 50,000 |

Keshav’s Capital Account

| Particulars | Amount (₹) | Particulars | Amount (₹) |

|---|---|---|---|

| To Keshav's Executor’s Loan A/c | 92,000 | By Balance b/d | 50,000 |

| By General reserve A/c | 5,000 | ||

| By Commission A/c (₹ 2,000 × 4 months) | 8,000 | ||

| By Goodwill A/c | 20,000 | ||

| By Revaluation A/c – Profit | 6,000 | ||

| By Profit and Loss Suspense A/c | 3,000 | ||

| Total | 92,000 | Total | 92,000 |

Practical Problems | Q 4 | Page 204

Virendra, Devendra, and Narendra were partners sharing Profit and Losses in the ratio of 3:2:1. Their Balance Sheet as on 31st March 2019 was as follows.

Balance Sheet as on 31st March 2019

| Liabilities | Amount ₹ | Assets | Amount ₹ |

|---|---|---|---|

| Bank Loan | 25,000 | Furniture | 50,000 |

| Creditors | 20,000 | Land & Building | 50,000 |

| Bills Payable | 5,000 | Motor Car | 20,000 |

| Reserve Fund | 30,000 | Sundry Debtors | 50,000 |

| Capital Account: | Bills Receivable | 20,000 | |

| Virendra | 90,000 | Investments | 50,000 |

| Devendra | 60,000 | Cash at Bank | 20,000 |

| Narendra | 30,000 | ||

| Total | 2,60,000 | Total | 2,60,000 |

Mr. Virendra died on 31st August 2019 and the Partnership deed provided that. That the event of the death of Mr. Virendra his executors be entitled to be paid out.

- The capital to his credit at the date of death.

- His proportion of Reserve at the date of the last Balance sheet.

- His proportion of Profits to date of death based on the average profits of the last four years.

- His share of Goodwill should be calculated at two years purchase of the profits of the last four years for the year ended 31st March were as follows -

2016 ₹ 40,000 2017 ₹ 60,000 2018 ₹ 70,000 2019 ₹ 30,000 - Mr. Virendra has drawn ₹ 3,000 p.m. to date of death, There is no increase and Decrease the value of assets and liabilities.

Prepare Mr. Virendras Executors A/c

Solution

In the books of the Partnership Firm Virendra’s Capital Account

| Particulars | Amount (₹) | Particulars | Amount (₹) |

|---|---|---|---|

| To Drawings A/c (₹ 3,000 × 5 months) | 15,000 | By Balance b/d | 90,000 |

| To Virendra's Executor’s Loan A/c | 1,50,417 | By Goodwill A/c | 50,000 |

| By Profit and Loss Suspense A/c | 10,417 | ||

| By Reserve Fund A/c | 15,000 | ||

| Total | 1,65,417 | Total | 1,65,417 |

Practical Problems | Q 5 | Page 204

The Balance Sheet of Sohan, Rohan and Mohan who were sharing profits and Losses in the ratio of 3:2:1 as follows.

Balance Sheet as on 31st March 2019

| Liabilities | Amount ₹ | Assets | Amount ₹ |

|---|---|---|---|

| Bank Overdraft | 18,000 | Bank | 48,000 |

| Creditors | 85,000 | Debtors | 30,000 |

| Bills payable | 40,000 | Land and Building | 40,000 |

| Bank Loan | 1,50,000 | Machinery | 80,000 |

| General Reserve | 27,000 | Investments | 40,000 |

| Capital Account : | Computers | 40,000 | |

| Sohan | 20,000 | Stock | 90,000 |

| Rohan | 20,000 | Patents | 12,000 |

| Mohan | 20,000 | ||

| Total | 3,80,000 | Total | 3,80,000 |

Mr. Rohan died on 1st October 2019 and the following adjustments were made.

- Goodwill of the firm is valued at 30,000

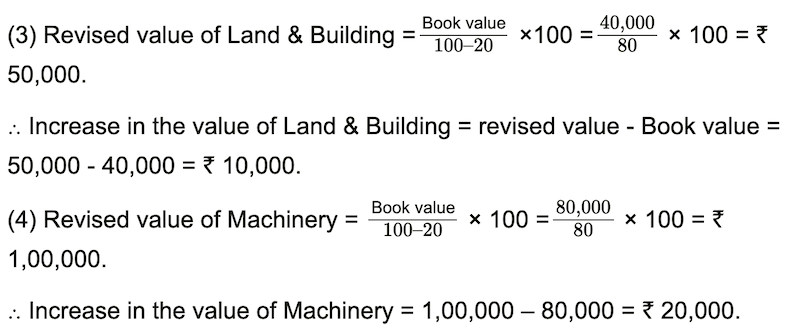

- Land and Building and Machinery were found to be undervalued by 20%

- Investments are valued at ₹ 60,000

- Stock to be undervalued by ₹ 5,000 and a provision of 10% as debtors were required.

- Patents were valueless

- Mr. Rohan was entitled to share in profits up to the date of death and it was decided that he may be allowed to retain his drawings as his share of profit. Rohan’s drawings till the date of death was ₹ 25,000

Prepare Partners' capital accounts.

Solution

In the books of the Partnership firm Partners’ Capital Accounts

| Particulars | Sohan (₹) | Rohan (₹) | Mohan (₹) | Particulars | Sohan (₹) | Rohan (₹) | Mohan (₹) |

|---|---|---|---|---|---|---|---|

| To Rohan's Executor’s Loan A/c | - | 49,000 | - | By Balance b/d | 20,000 | 20,000 | 20,000 |

| To Drawings A/c | - | 25,000 | - | By Revaluation A/c (Profit) | 15,000 | 10,000 | 5,000 |

| To Balance c/d | 63,500 | - | 34,500 | By General reserve A/c | 13,500 | 9,000 | 4,500 |

| By Goodwill A/c | 15,000 | 10,000 | 5,000 | ||||

| By Profit and Loss Suspense A/c | 25,000 | ||||||

| Total | 63,500 | 74,000 | 34,500 | Total | 63,500 | 74,000 | 34,500 |

Working Notes (for Q5):

(1) Revaluation Account (Summary of Effects):

| Particulars (Debit - Expenses/Losses) | Amount (₹) | Particulars (Credit - Incomes/Gains) | Amount (₹) |

|---|---|---|---|

| To Stock A/c (Reduction in value) | 5,000 | By Land and Building A/c (Increase) | 10,000 |

| To R.D.D. A/c (Provision) | 3,000 | By Machinery A/c (Increase) | 20,000 |

| To Patents A/c (Written off) | 12,000 | By Investments A/c (Increase) | 20,000 |

| To Partners’ Capital A/cs – Profit: | |||

| Sohan (3/6) | 15,000 | ||

| Rohan (2/6) | 10,000 | ||

| Mohan (1/6) | 5,000 | ||

| 30,000 | |||

| Total | 50,000 | Total | 50,000 |

(2) Goodwill: Firm’s goodwill is valued at ₹30,000. This is credited to all partners in their old profit-sharing ratio (3:2:1). Sohan: ₹15,000, Rohan: ₹10,000, Mohan: ₹5,000.

(3) Land & Building and Machinery Undervaluation by 20%:

- Land and Building: Book Value ₹40,000. If undervalued by 20%, this represents 80% of true value. True Value = ₹40,000 / 0.80 = ₹50,000. Increase = ₹10,000.

- Machinery: Book Value ₹80,000. True Value = ₹80,000 / 0.80 = ₹1,00,000. Increase = ₹20,000.

(4) Investments: Valued at ₹60,000. Book Value ₹40,000. Increase = ₹20,000.

(5) Stock and R.D.D.:

- 'Stock to be undervalued by ₹5,000': This means the stock's value is to be reduced by ₹5,000 from its current book value (₹90,000) for revaluation. New value ₹85,000. Reduction/Loss = ₹5,000 (Debit Revaluation Account).

- Provision for Doubtful Debts (R.D.D.): 10% on Debtors (₹30,000) = ₹3,000 (Debit Revaluation Account).

(6) Patents: Were valueless. Book Value is ₹12,000. Loss = ₹12,000 (Debit Revaluation Account).

(7) Rohan’s Share of Profit: Rohan was entitled to retain his drawings (₹25,000) as his share of profit up to the date of death. His share of profit is determined to be ₹25,000. This amount is credited to Rohan's Capital Account (via Profit & Loss Suspense A/c), and the drawings of ₹25,000 are debited to his Capital Account.

Difficult Words and Their Meanings

- Reconstitution of Partnership: The process of changing the existing agreement among partners due to events like admission, retirement, or death of a partner, or a change in their profit-sharing ratio, leading to a new partnership agreement.

- Partnership: A business structure where two or more individuals (partners) agree to share in the profits or losses of a business. A partnership agreement outlines the terms.

- Executor: A person appointed by a testator (person making a will) to carry out the terms of their will after their death. In partnership, the executor represents the deceased partner's estate and claims their dues from the firm.

- Goodwill: An intangible asset representing the good reputation, brand name, customer loyalty, and other factors that give a business an earning capacity greater than the return on its tangible assets.

- R.D.D. (Reserve for Doubtful Debts): A provision made in accounts to cover potential losses from customers (debtors) who may not pay their dues. It reduces the net value of debtors.

- Balance Sheet: A financial statement that reports a company's assets, liabilities, and equity at a specific point in time, providing a snapshot of its financial position.

- Liabilities: A company's legal financial debts or obligations that arise during the course of business operations (e.g., loans, accounts payable, accrued expenses).

- Assets: Resources with economic value that an individual, corporation, or country owns or controls with the expectation that they will provide future benefit (e.g., cash, buildings, machinery, investments).

- Creditors (Sundry Creditors): Persons or entities to whom the business owes money for goods or services purchased on credit.

- Debtors (Sundry Debtors): Persons or entities who owe money to the business for goods or services sold on credit.

- Depreciation: The systematic allocation of the cost of a tangible asset over its useful life, reflecting its wear and tear or obsolescence.

- Appreciation: An increase in the value of an asset over time, often due to market conditions or improvements.

- Profit and Loss Adjustment Account (or Revaluation Account): An account prepared to record the changes in the values of assets and liabilities at the time of reconstitution of a partnership (admission, retirement, death).

- Capital Account: An equity account for each partner, recording their initial investment, additional contributions, withdrawals, and share of profits or losses.

- Undervalued: Stated or recorded at a value less than the true or fair market value. For example, "Land and Building were found to be undervalued by 20%" means their book value was 20% lower than it should be. "Stock to be undervalued by ₹5,000" (in Q5 context) means its value is to be reduced by ₹5,000.

- Valueless: Having no financial or monetary worth.

- Proportionate: Corresponding in size, amount, or degree to something else; having a correct relative size.

- Preceding: Coming before something in order, position, or time.

- Bills Payable: A short-term liability representing a written promise by the business to pay a specified sum of money to a creditor at a future date.

- General Reserve: An amount set aside out of profits, not for any specific purpose, but to strengthen the financial position of the business or meet unforeseen contingencies.

- Profit and Loss Suspense Account: A temporary account used to record the estimated share of profit or loss for a deceased or retiring partner for the period from the last balance sheet date to the date of their death or retirement.

- Drawings: Amounts withdrawn by partners from the business for their personal use, either in cash or in kind.

- Patents: Exclusive rights granted by a government to an inventor for a limited period, preventing others from making, using, or selling the invention. It's an intangible asset.