Chapter 3: Journal

Answer in One Sentence:

What is Journal ?

SOLUTION:

A journal is a book prepared to classify or sort out transactions in a form convenient for their subsequent entry in the ledger.

What is Narration?

SOLUTION:

Narration is a brief explanation about the transaction.

What is GST?

SOLUTION:

GST means Goods and Service Tax. GST is one nation, one tax, one market.

In which year GST was imposed by the Central Government of India?

SOLUTION:

GST was imposed by the Central Government of India in the year 2017 (1st July 2017).

What is meant by simple entry ?

SOLUTION:

For a transaction, entry in which only two accounts are affected, one account is debited and the other account is credited, is known as simple entry.

What is the meaning of Combined Entry?

SOLUTION:

A journal entry which contains more than one debit or more than one credit or both effects of a transaction is known as a combined/compound journal entry.

Which account is debited, when rent is paid by debit card?

SOLUTION:

When rent is paid by debit card, Rent A/c is debited.

Which discount is not recorded in the books of account?

SOLUTION:

Trade discount is not recorded in the books of account.

In which order monthly transactions are recorded in a journal?

SOLUTION:

In the order of their occurrence, monthly transactions are recorded in a journal.

Which account is credited, when goods are sold on credit?

SOLUTION:

When goods are sold on credit, Sales account is credited.

Give one word/term or phrase for the following statement:

A book of prime entry.

SOLUTION:

Journal

The tax imposed by Central Government on Goods and Services

SOLUTION:

GST Goods and Service Tax

Brief explanation of an entry.

SOLUTION:

Narration

The process of recording transactions in the Journal.

SOLUTION:

Journalising

The French word from which the word Journal is derived.

SOLUTION:

JOUR

Concession given for immediate payment.

SOLUTION:

Cash discount

Entry in which more than one accounts are to debited or credited.

SOLUTION:

Combined/Compound Journal Entry

Anything taken by proprietor from business for his private use.

SOLUTION:

Drawings

Tax payable to the Government on purchase of goods.

SOLUTION:

Input CGST and Input SGST or Input Tax

Page number of the ledger.

SOLUTION:

Ledger Folio

Select the most appropriate alternative from the alternatives given below and rewrite the statement.

_________ means explanation of the transactions recorded in the Journal.

Options

Narration

Journalising

posting

Casting

SOLUTION:

Narration means explanation of the transactions recorded in the Journal.

_________ discount is not recorded in the books of accounts.

Options

Trade

Cash

GST

VAT

SOLUTION:

Trade discount is not recorded in the books of accounts

Recording of transaction in Journal is called ______.

Options

posting

journalising

narration

prime entry

SOLUTION:

Recording of transaction in Journal is called journalising

Every Journal entry require ______.

Options

casting

posting

narration

journalising

SOLUTION:

Every Journal entry require posting.

The ______ column of the Journal is not recorded at the time of journalising

Options

date

particulars

ledger folio

amount

SOLUTION:

The ledger folio column of the Journal is not recorded at the time of journalising.

Goods sold on credit should be debited to _________.

Options

purchase A/c

customer A/c

sales A/c

cash A/c

SOLUTION:

Goods sold on credit should be debited to customer A/c.

Wages paid for installation of Machinery should be debited to _________

Options

wages A/c

machinery A/c

cash A/c

Installation A/c

SOLUTION:

Wages paid for installation of Machinery should be debited to machinery A/c.

The commission paid to the agent should be debited to _________

Options

drawing A/c

cash A/c

commission A/c

Agent A/c

SOLUTION:

The commission paid to the agent should be debited to commission A/c

Loan taken from Dena Bank should be credited to ________

Options

Capital A/c

Dena Bank A/c

Cash A/c

Dena Bank Loan A/c

SOLUTION:

Loan taken from Dena Bank should be credited to Dena Bank Loan A/c.

Purchase of animals for cash should be debited to ________

Options

Live stock A/c

Goods A/c

Cash A/c

Bank A/c

SOLUTION:

Purchase of animals for cash should be debited to Live stock A/c.

State whether the following statement is True or False with reasons.

Narration is not required for each and every entry.

Options

True

False

SOLUTION:

This statement is False.

Narration is nothing but brief explanation of entry/transaction, based on that one Can pass journal entry. Therefore, narration is required for each and every entry.

A journal voucher is must for all transactions recorded in the journal.

Options

True

False

SOLUTION:

This statement is True.

Journal voucher is basic/original voucher on the basis of which the transactions should be journalised in journal book, so we can say that journal voucher is must for all transactions recorded in the journal.

Cash discount allowed should be debited to discount A/c.

Options

True

False

SOLUTION:

This statement is True.

Cash discount allowed is an expense for the business and every expense should be debited. Therefore cash discount allowed should be debited to Discount A/c.

Journal is a book of prime entry.

Options

True

False

SOLUTION:

This statement is True.

For every financial transaction, initially, an entity is recorded in the book known as ‘Journal'. Therefore, we can say that journal is a book of prime entry

Trade discount is recorded in the books of accounts.

Options

True

False

SOLUTION:

This statement is False.

Trade discount is a general discount, allowed on catalog price or on the price list price. For increasing the sale or to give sufficient margin to retailers, generally trade discount is allowed. Therefore, the trade discount is not to be recorded in the books of accounts.

Goods lost by theft is debited to goods A/c.

Options

True

False

SOLUTION:

This statement is False.

As per Real A/c rule, debit what comes in and credit what goes out. Here, goods lost by theft means goods goes out. Therefore, goods lost by theft is to be credited to Goods A/c.

If rent is paid to landlord, landlord's A/c should be debited.

Options

True

False

SOLUTION:

This statement is False.

Rent paid is an expense and Rent paid A/c should be debited, not Landlord A/c be debited.

Book Keeping records monetary and non-monetory transactions

Options

True

False

SOLUTION:

This statement is False.

In the books of accounts, only financial transactions are to be recorded. Means non-monetary transactions are not be recorded.

Drawings made by the proprietor increases his capital

Options

True

False

SOLUTION:

This statement is False.

Drawings means anything withdrawn by the proprietor in the form of cash, goods, assets or services from the business for personal use. And it decreases the capital of proprietors.

GST paid on purchase of goods Input tax A/c should be debited.

Options

True

False

SOLUTION:

This statement is True.

When goods are purchased, any tax payable on it is an expense for the business. Therefore, we can say that when GST is paid. Input Tax should be debited.

Fill in the blank:

The first book of original entry is the _________

SOLUTION:

The first book of original entry is the Journal

The process of recording transaction into journal is called _________

SOLUTION:

The process of recording transaction into journal is called Journalising.

An explanation of the transaction recorded in the journal _________

SOLUTION:

An explanation of the transaction recorded in the journal narration.

___________ discount is not recorded in the books of accounts.

SOLUTION:

Trade discount is not recorded in the books of accounts.

___________ is concession allowed for bulk purchase of goods or for immediate payment.

SOLUTION:

Cash discount is concession allowed for bulk purchase of goods or for immediate payment.

Every Journal Entry requires ________.

SOLUTION:

Every Journal Entry requires voucher.

___________ discount is always recorded in the books of accounts.

SOLUTION:

Cash discount is always recorded in the books of accounts.

___________ is the document on the basis of which the entry is recorded in journal.

SOLUTION:

Voucher is the document on the basis of which the entry is recorded in journal.

There are _______ parties to a cheque

SOLUTION:

There are three parties to a cheque

The _______ cheque is more safe than other cheques as it cannot be encashed on the counter of the bank.

SOLUTION:

The crossed cheque is more safe than other cheques as it cannot be encashed on the counter of the bank.

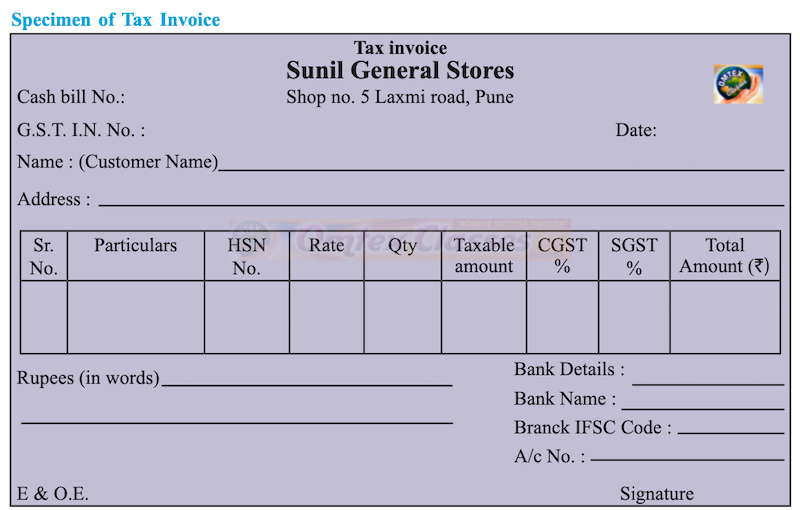

Prepare specimen of Tax Invoice

Prepare specimen of Receipt

Prepare specimen of Crossed cheque

Prepare specimen of Cash voucher.

Correct the following statement and rewrite the statement:

All business transactions are recorded in the Journal.

SOLUTION:

Only monetary transactions are recorded in the Journal.

Cash discount is not recorded in the books of accounts

SOLUTION:

Cash discount is recorded in the books of accounts

Journal is a book of Secondary entry.

SOLUTION:

Journal is a book of Prime entry

GST is imposed by the Government of India from 1st July 2018.

SOLUTION:

GST is imposed by the Government of India from 1st July, 2017.

Machinery purchased by the Proprietor decreases his capital

SOLUTION:

Machinery purchased by the proprietor increases his Capital

Balbharati Solutions for Book-keeping and Accountancy 11th Standard HSC Maharashtra State Board Chapterwise List - Free

Chapter 1: Introduction to Book - Keeping and Accountancy

Chapter 2: Meaning and Fundamentals of Double Entry Book-Keeping

Chapter 6: Bank Reconciliation Statement

Chapter 8: Rectification of Errors

Chapter 9: Final Accounts of a Proprietary Concern

Chapter 10: Single Entry System