HSC-Accounts-Paper-2020-Std-12th-Commerce-Maharashtra-Board.

Book Keeping & Accountancy (50)

March 2020 Board Paper with Solution

Book Keeping & Accountancy (50)

March 2020 Board Paper with Solution

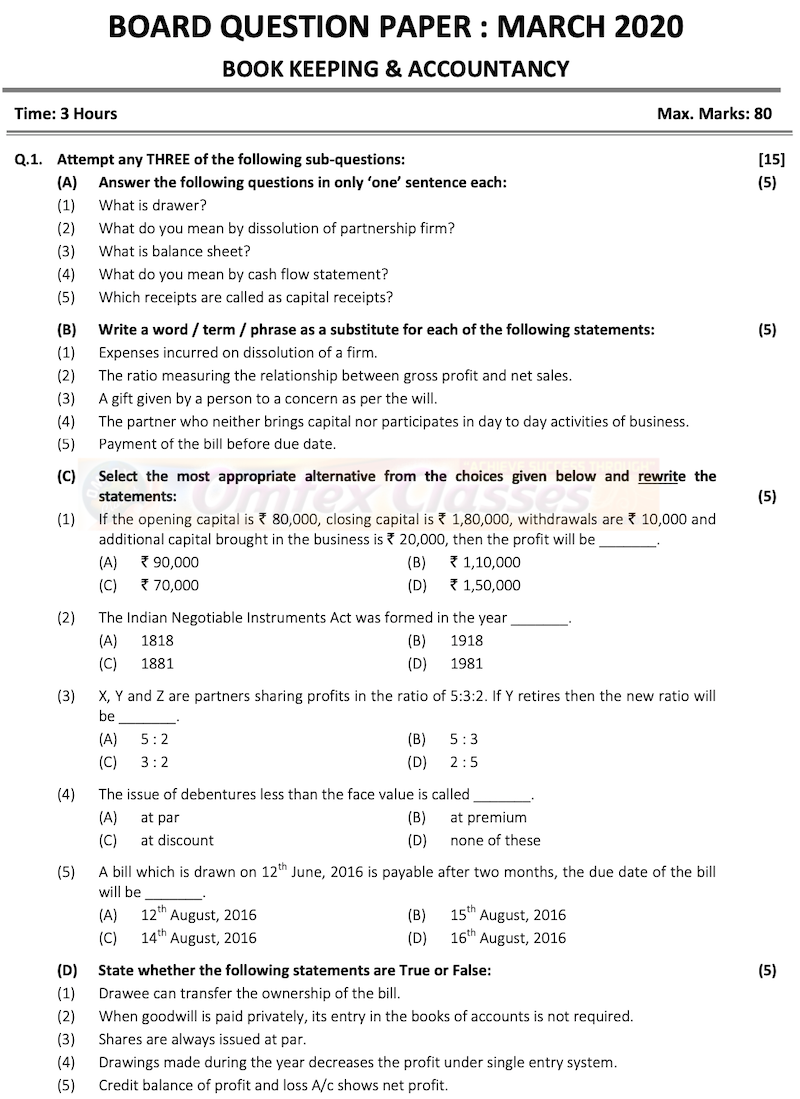

Q.1. Attempt any Three of the Following sub-questions:

(A) Answer the following questions in only 'one' sentence each. (5)

(1) Answer:

The person who draws or makes the bill of exchange is called the drawer. He is the creditor. He will receive the money from the debtor.

(2) Answer:

Dissolution means termination of the existing relationship between the partners of a firm. It means that the business will come to an end and the firm will wind up its business.

(3) Answer:

A balance sheet is a statement showing the financial position of the firm at a particular date.

(4) Answer:

A statement which shows inflow and outflow of cash and cash equivalents from operating, investing and financing activities during a specific period.

(5) Answer:

Capital Receipts are those receipts which are non – recurring in nature and not forming a part of regular flow of income of a concern. E.g. specific donation received for construction of a building.

(1) Answer:

The person who draws or makes the bill of exchange is called the drawer. He is the creditor. He will receive the money from the debtor.

(2) Answer:

Dissolution means termination of the existing relationship between the partners of a firm. It means that the business will come to an end and the firm will wind up its business.

(3) Answer:

A balance sheet is a statement showing the financial position of the firm at a particular date.

(4) Answer:

A statement which shows inflow and outflow of cash and cash equivalents from operating, investing and financing activities during a specific period.

(5) Answer:

Capital Receipts are those receipts which are non – recurring in nature and not forming a part of regular flow of income of a concern. E.g. specific donation received for construction of a building.

(B) Write a word / term / phrase as a substitute for each of the following statements: (5)

(1) Answer:

Dissolution Expenses / Realisation Expenses

(2) Answer:

Gross Profit Ratio

(3) Answer:

Legacies

(4) Answer:

Nominal partner.

(5) Answer:

Retirement of Bill of Exchange

(1) Answer:

Dissolution Expenses / Realisation Expenses

(2) Answer:

Gross Profit Ratio

(3) Answer:

Legacies

(4) Answer:

Nominal partner.

(5) Answer:

Retirement of Bill of Exchange

(C) Select the most appropriate alternative from the choices given below and rewrite the statements:

(1) Answer:

Rs. 90,000

(2) Answer:

1881

(3) Answerr:

5:2

(4) Answer:

at discount

(5) Answer:

14th August, 2016

(D) State whether the following statements are True or False:

(1) Answer:

False

(2) Answer:

True

(3) Answer:

False

(4) Answer:

False

(5) Answer:

True

(E) Prepare a format of Bill of Exchange from the following information. (5)

Solution:

In the books of Shri Amar

Statement of Affairs as on 31st March, 2016.

Liabilities

Amount

(Rs.)

Assets

Amount

(Rs.)

Capital at the End of the Year.

92245

Cash

4720

Stock

5125

Bills Payable

7400

Debtors

20000

Creditors

8150

Prepaid Insurance

300

Bills Receivable

15150

Premises

42400

Vehicles

20100

107795

107795

Statement of Profit or Loss For the year ended 31st March, 2016.

Particulars

Amount

Rs.

Amount

Rs.

Capital at the end of the account year.

92245

Add : Drawings

5000

Less: Additional Capital introduced on 30th September, 2015

10000

Less: Capital at the beginning of the account year.

70000

Trading Profit

17245

Less: Depreciation

On Vehicle

On Premises

2010

4240

6250

Less: Bad debts

1000

Less: R.D.D. @3%

= (Debtor - Bad debts) x 3%

= (20000 - 1000) x 3%

= 19000 x 3%

= Rs. 570

570

Less: Interest on Capital @ 5%

On Opening Capital = 70000 x 5% = Rs. 3500

On Additional Capital = 10000 x 5% x (6 months) = Rs. 250

3750

Add: Creditors Written off

3180

Net Profit

8855

(1) Answer:

Rs. 90,000

(2) Answer:

1881

(3) Answerr:

5:2

(4) Answer:

at discount

(5) Answer:

14th August, 2016

(D) State whether the following statements are True or False:

(1) Answer:

False

(2) Answer:

True

(3) Answer:

False

(4) Answer:

False

(5) Answer:

True

(E) Prepare a format of Bill of Exchange from the following information. (5)

Solution:

In the books of Shri Amar

Statement of Affairs as on 31st March, 2016.

Liabilities | Amount (Rs.) | Assets | Amount (Rs.) |

Capital at the End of the Year. | 92245 | Cash | 4720 |

Stock | 5125 | ||

Bills Payable | 7400 | Debtors | 20000 |

Creditors | 8150 | Prepaid Insurance | 300 |

Bills Receivable | 15150 | ||

Premises | 42400 | ||

Vehicles | 20100 | ||

107795 | 107795 |

Statement of Profit or Loss For the year ended 31st March, 2016.

Particulars | Amount Rs. | Amount Rs. |

Capital at the end of the account year. | 92245 | |

Add : Drawings | 5000 | |

Less: Additional Capital introduced on 30th September, 2015 | 10000 | |

Less: Capital at the beginning of the account year. | 70000 | |

Trading Profit | 17245 | |

Less: Depreciation On Vehicle On Premises | 2010 4240 | 6250 |

Less: Bad debts | 1000 | |

Less: R.D.D. @3% = (Debtor - Bad debts) x 3% = (20000 - 1000) x 3% = 19000 x 3% = Rs. 570 | 570 | |

Less: Interest on Capital @ 5% On Opening Capital = 70000 x 5% = Rs. 3500 On Additional Capital = 10000 x 5% x (6 months) = Rs. 250 | 3750 | |

Add: Creditors Written off | 3180 | |

Net Profit | 8855 |