PRACTICAL PROBLEMS [PAGES 161 - 167]

Balbharati solutions for Book-keeping and Accountancy 12th Standard HSC Maharashtra State Board Chapter 3 Reconstitution of Partnership (Admission of Partner) Practical Problems [Pages 161 - 167]

Practical Problems | Q 4 | Page 163

Mr. Deep & Mr. Karan were in Partnership sharing Profits & Losses in the proportion of 3:1 respectively. Their Balance Sheet On 31st March 2018 Stood as follows

Balance Sheet as on 31st March

Liabilities | Amount (₹) | Amount (₹) | Assets | Amount (₹) | Amount (₹) |

Sundry Creditors | 40,000 | Cash | 40,000 | ||

Bill Payable | 10,000 | Sundry debtors | 32,000 | ||

Bank Overdraft | 11,000 | Land & Building | 16,000 | ||

Capital A/c: Deep Kara | 60,000 20,000 | 80,000 | Stock | 20,000 | |

General Reserve | 8,000 | Plant and machinery | 30,000 | ||

Furniture | 11,000 | ||||

1,49,000 | 1,49,000 |

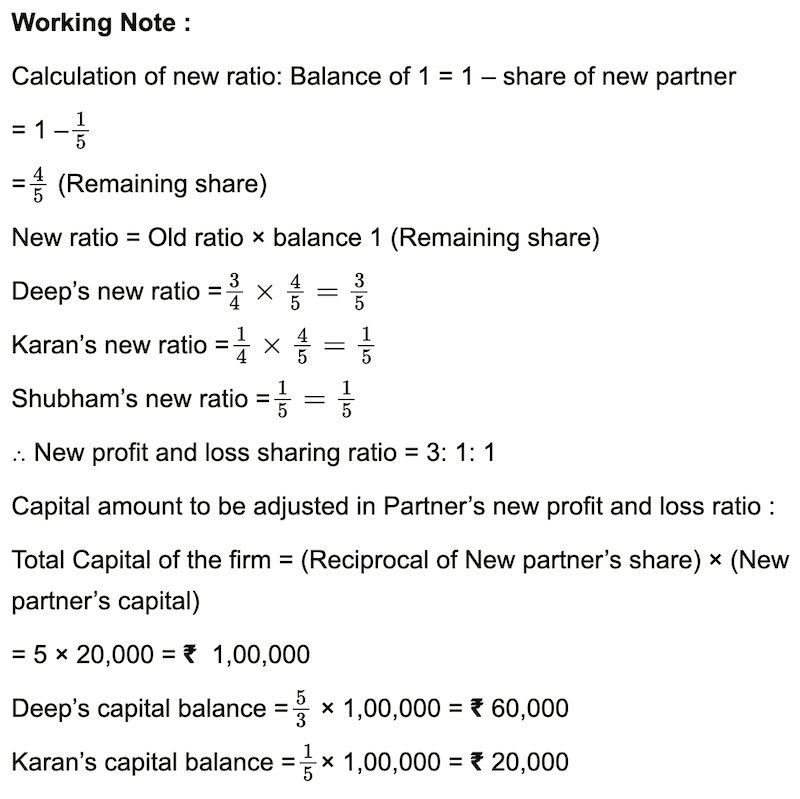

They admit Shubham into Partnership on 1 April 2018 The term being that:

1. He shall have to bring in ₹ 20,000 as his capital for 1/5 Share in future profits & 10,000 as his share of Goodwill.

2. A Provision for 5% doubtful debts to be created on Sundry Debtors.

3. Furniture to be depreciated by 20%

4. Stock should be appreciated by 5% and Building be appreciated by 20%

5. Capital A/c of all partners be adjusted in their new profit sharing ratio through a cash account.

Prepare Profit and Loss Adjustment A/c, Partner’s Capital A/c, Balance sheet of the new firm.

Solution:

Dr | In the books of the firm --- Profit and Loss Adjustment Account | Cr | |||

Particulars | Amount ( ₹ ) | Particulars | Amount ( ₹ ) | ||

To R.D.D. (New) A/c | 1,600 | By Stock A/c | 1,000 | ||

To Depreciation A/c – Furniture | 2,200 | By Building A/c | 3,200 | ||

To Profit on Revaluation Transferred to Partners’ Capital A/cs: Deep 300 Karan 100 | 400 | ||||

4,200 | 4,200 | ||||

Dr. | Partners’ Capital Accounts | Cr. | |||||||

Particulars | Deep (₹ ) | Karan (₹ ) | Shubham (₹ ) | Particulars | Deep (₹ ) | Karan (₹ ) | Shubham (₹ ) | ||

To Cash A/c | 13,800 | 4,600 | By Balance b/d | 60,000 | 20,000 | ||||

To Balance c / d | 60,000 | 20,000 | 20,000 | By Cash / Bank A/c | 20,000 | ||||

By Goodwill A/c | 7,500 | 2,500 | |||||||

By Revaluation on A/c (Profit) | 300 | 100 | |||||||

By General Reserve A/ | 6,000 | 2,000 | |||||||

73,800 | 24,600 | 20,000 | 73,800 | 24,600 | 20,000 | ||||

Balance Sheet as on 1st April 2018

Liabilities | Amount (₹ ) | Amount (₹ ) | Assets | Amount (₹ ) | Amount (₹ ) |

Cash | 51,600 | ||||

Capital A/cs : Deep Karan Shubham | 60,000 20,000 20,000 | 1,00,000 | Sundry Debtors Less: R.D.D | 32,000 1,600 | 30,400 |

Sundry Creditors | 40,000 | Land and Building Add: Appreciation | 16,000 3,200 | 19,200 | |

Bills Payable | 10,000 | Stock Add: Appreciation | 20,000 1,000 | 21,000 | |

Bank Overdraft | 11,000 | Furniture Less: Depreciation | 11,000 2,200 | 8,800 | |

Plant and Machinery | 30,000 | ||||

1,61,000 | 1,61,000 |

Dr | Cash Account | Cr | |||

Particulars | Amount (₹ ) | Particulars | Amount (₹ ) | ||

To Balance b / d | 40,000 | By Deep’s Capital A/c | 13,800 | ||

To Shubham’s Capital A/c | 20,000 | By Karan’s Capital A/c | 4,600 | ||

To Goodwill A/c | 10,000 | By Balance c / d | 51,600 | ||

70,000 | 70,000 | ||||

PRACTICAL PROBLEMS [PAGES 161 - 167]

Balbharati solutions for Book-keeping and Accountancy 12th Standard Hsc Maharashtra State Board Chapter 3 Reconstitution of Partnership (Admission of Partner) Practical Problems [Pages 161 - 167]

Practical Problems | Q 1 | Page 161

Practical Problems | Q 2 | Page 161

Practical Problems | Q 3 | Page 162

Practical Problems | Q 4 | Page 163

Practical Problems | Q 5 | Page 163

Practical Problems | Q 6 | Page 164

Practical Problems | Q 7 | Page 164

Practical Problems | Q 8 | Page 165

Practical Problems | Q 9 | Page 166

Practical Problems | Q 10 | Page 167

Select appropriate alternatives from those given below and rewrite the sentence.

Write a word/phrase/term which can substitute the following statement.

State True or False with reason.

Calculate the following.

Calculate the following.

Calculate the following.

Book-keeping and Accountancy 12th Standard

HSC Maharashtra State Board. Latest Syllabus.

Chapter 1: Introduction to Partnership and Partnership Final Accounts

Chapter 2: Accounts of ‘Not for Profit’ Concerns

Chapter 3: Reconstitution of Partnership (Admission of Partner)

Chapter 4: Reconstitution of Partnership (Retirement of Partner)

Chapter 5: Reconstitution of Partnership (Death of Partner)

Chapter 6: Dissolution of Partnership Firm

Chapter 8: Company Accounts - Issue of Shares

Chapter 9: Analysis of Financial Statements

Chapter 10: Computer In Accounting

ACCOUNTS BOARD PAPERS

HSC Accounts March 2020 Board Paper With Solution

MARCH 2014 : View | PDF Download

OCTOBER 2014 View | PDF Download

MARCH 2015 View | PDF Download

JULY 2015 View | PDF Download

MARCH 2016 View | PDF Download

JULY 2016 View | PDF Download

JULY 2017 View | PDF Download

MARCH 2017 View | PDF Download

MARCH 2018 View | PDF Download

JULY 2018 View | PDF Download

MARCH 2019 View | PDF Download

MARCH 2020 View | PDF Download